Since 2009, the U.S. economy has had more than 110 consecutive months of growth, making this the second longest economic expansion since the Great Depression. After a rather tepid 2017 performance, the U.S. office market gathered some steam in 2018, adding 76 million square feet of new office space and completing roughly 396 new projects in its top 40 most active markets for office completions.

Using Yardi Matrix data we’ve examined what 2019 may have in store for the U.S. office market. According to numbers recorded up to April 9th, on a national level 662 buildings and a whopping 115 million square feet of new office space are on track for delivery this year. While some reports raise concerns about how the pace of development will be affected by tariff and trade wars, growing construction costs and labor shortages, the office sector is expected to hold up better than it has in earlier downturns. This is mainly due to more restrained lending practices, a more moderate pace of development and the concentration of new office properties in markets with significant job growth.

Keep reading for more details about the hottest markets for office development and learn about the top 10 office projects that came online in 2018 and the largest developments in the pipeline for 2019.

Dallas Office Completions in 2018 Totaled 7 MSF, Second Only to NYC

Developers completed roughly 8.3 million square feet of new office space in Manhattan, Brooklyn, and Queens in 2018, increasing the city’s 520 million square foot office inventory by 2% and placing it in first place among the top 40 markets for office deliveries. Dallas office space came in second, with 7 million square feet of new developments and 31 completed projects, and is expected to deliver 6.6 million square feet of new office space by the end of 2019. Miami office space saw a growth of 5% ―the fastest rate among the top 40 markets for office completions―as 11 projects delivered 3 million square feet of new office space in the past year.

Check out the list of markets with the largest number of office completions in 2018:

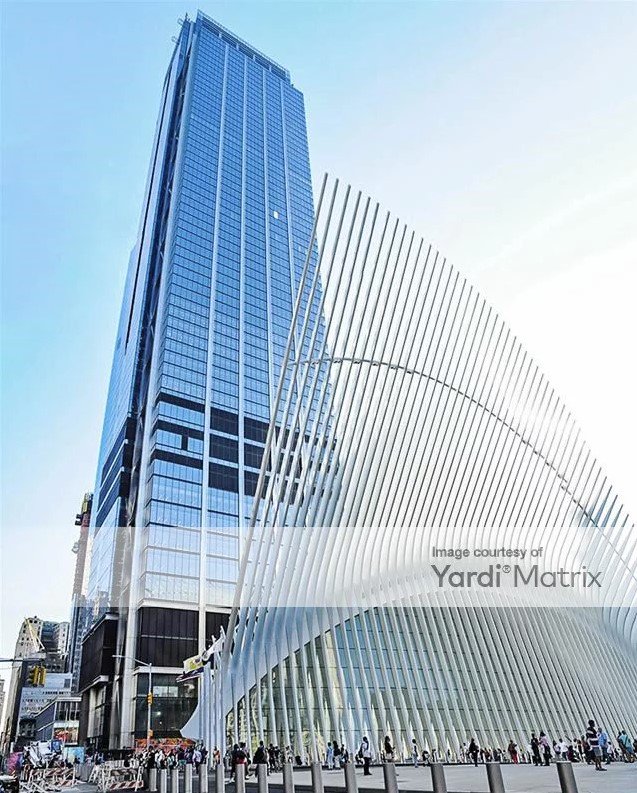

The 80-story 3 World Trade Center was completed in June and added 2.8 million square feet of new Financial District office space to the New York market, earning the title of the largest office project to come online in 2018. The 1,079-foot tower, currently owned by Silverstein Properties, is the second-tallest building in the World Trade Center complex and the fifth-tallest in the city.

Designed by architect Richard Rogers of Rogers Stirk Harbour+Partners, the property features a series of exterior load-bearing steel frames that have allowed for spacious column-free floor plates at 3 WTC, ranging in size between 30,000 and 70,000 square feet. The building at 175 Greenwich Street sports three outdoor terraces on the 17th, 60th and 76th floors, as well as five floors of retail, including 350,000 square feet of underground retail shared with the World Trade Center Transportation Hub. The property is located near the Oculus transportation hub, with access to 12 different train lines.

The Downtown Manhattan office space has attracted a host of important media companies, such as Conde Nast, AP, Harper Collins, Macmillan and its anchor tenant, media-investment management giant GroupM. The company has signed a 20-year lease for 700,000 square feet in the tower’s base.

3 World Trade Center, 175 Greenwich Street, New York

The second largest delivery of 2018 was the Comcast Technology Center, completed last August. The structure is 1,121 feet tall, when including the Art Deco lantern light blade, and increased the existing Philadelphia office space inventory by an additional 1.56 million square feet.

Construction on the 59-story skyscraper at 1800 Arch Street began in 2014 and has faced difficulties due to tight labor conditions, rising construction material prices due to high demand and tariffs, which ultimately resulted in $67 million cost overruns for owner Liberty Property Trust.

The CTC was designed to attract techies, engineers, software architects, hotel guests, and the employees of Comcast-owned NBC 10 and Telemundo 62, formerly based at the company’s Bala Cynwyd studios.

Tenants and guests can enjoy the creations of award-winning chef Greg Vernick at his on-site Vernick Coffee Bar, a ‘contemporary seafood-centered eatery.’ The restaurant is part of the grounds occupied by the Four Seasons Hotel on the 12th floor, which includes 218 rooms with 38 suites, a fitness center, spa, a lounge, and an indoor pool.

NYC 2019 Pipeline Expected to Deliver 16 MSF of New Office Space

New York City leads the list of top 40 for office deliveries in 2019 with 46 projects currently underway that will add 16 million square feet to the market, followed by the Bay Area in second place, with 37 projects and a total of 10 million square feet of new office space.

Chicago’s 23 scheduled office deliveries for 2019 add up to roughly 5.6 million square feet of new space, 116% more than the amount completed in 2018, when the market’s office inventory grew by 2.6 million square feet.

Seattle’s expected office delivery numbers have jumped by 286%, as 26 properties totaling 6.4 million square feet of new office space should hit the market by the end of the year, according to Yardi Matrix data.

Six California markets have made it into our top 40 list for scheduled office completions for 2019. Between them, the Bay Area, San Francisco, Los Angeles, Sacramento, San Diego, and Orange County are expected to add roughly 26 million square feet of new office space this year to their existing inventories.

Orlando is the only office market in Florida where the total number of properties expected to come online this year exceeds the 1 million-square-foot mark, as 7 projects are set to increase the office inventory by 1.1 million square feet.

Check out the full top 40 below:

30 Hudson Yards Adds 2.6MSF of Office Space to Midtown Manhattan

Apple’s new California campus has topped the list of top office completions throughout 2018 at 2.9 million square feet of Cupertino office space, but although several phases have been successfully completed, the building is not yet ready for occupancy.

Check out the 10 largest office projects to come online in 2019 below:

30 Hudson Yards is scheduled for completion by the end of March, adding 2.6 million square feet of new Hudson Yards office space to the Manhattan market. Located at 500 West 33rd Street, the 90-story skyscraper developed by Related Companies and Oxford Properties Group and owned by WarnerMedia has been a magnet for top-notch tenants looking to secure a spot in the fourth tallest office tower under construction in New York City.

Designed by Kohn Penderson Fox, the building stands 1,296 feet tall and will have the highest observation deck in the city, suspended at 1,100 feet in the air. 30 Hudson Yards is subject to a 30-year PILOT ground lease, held by the New York City Industrial Development and expiring in June 2043.

Once it moves from its previous location at Time Warner Center, WarnerMedia and its associates ― including CNN, HBO, Warner Bros. and Turner ― will occupy roughly 1.4 million square feet of the Midtown Manhattan office space. Some of the other companies that have lined up to sign leases for Hudson Yards’ tallest office tower are Norway’s largest bank, DNB ASA, with 44,000 square feet of space on the property’s top floors, Wells Fargo Securities with 500,000 square feet of office space and global investment firm KKR which will have 343,000 square feet of office space.

The Post Office in Chicago, currently owned by New York-based 601W Companies, is expected to come online by August, expanding the Windy City’s office inventory by 2.5 million square feet South Loop Chicago office space. The present $500 million development puts an end to decades of neglect and unrealized projects that promised to breathe new life into the massive Art Deco building on 433 West Van Buren Street.

601W owns several other properties locally, including the Aon Center, One South Wacker, 550 West Jackson Blvd, and the Sullivan Center, encompassing roughly 5.2 million square feet of Chicago office space in the Chicago Loop and West Side Chicago submarkets. Its plans to use the Post Office’s factory style open floor to create a flexible office space in a prime location near Union Station had gained the support of Mayor Rahm Emanuel, who went on to promote the building as a potential home for Amazon’s second headquarters. The City Council’s Finance Committee agreed to provide 601W with a Class L property tax break, saving the owner roughly $100 million over the life of the project.

Once completed, the former Post Office would have a 3-acre rooftop park, a fitness center and events space, outdoor cafes, and a grand plaza on the riverfront. The property has attracted several important tenants, penning a deal with Walgreens for 200,000 square feet of office space that will house the company’s digital, mobile, e-commerce, and IT workers, along with Walgreens’ University training program. Local confectionary Ferrara Candy will also join the Post Office’s tenant roster, as it plans to move its employees into the building by late summer 2019.

Methodology

We used detailed Yardi Matrix data to analyze all office projects equal to or in excess of 50,000 square feet currently under construction in the U.S., with completion dates scheduled for 2019. Our analysis, based on data recorded up until April 9th, 2019, includes office spaces in buildings that are used primarily for office purposes―in the case of mixed-use properties, this includes office, retail, multi-family, and other commercial use types). The New York City pipeline includes the boroughs of Manhattan, Brooklyn and Queens. Properties that include more than one building are represented in the “No. of Buildings” columns.