As the U.S. office sector continues to navigate the complex, post-2020 landscape, it evolves under the influence of shifting economic winds, changing work trends, and the need to refresh a significant portion of the national office stock. While general discourse in the face of headwinds tends to lament the future of office space, the sector itself has historically adapted to changing dynamics and bounced back stronger.

Even as this particular round of headwinds feels unprecedented in scale and character, the U.S. office sector is perhaps more likely than ever to adapt creatively to currents such as shifting workforce paradigms, evolving space requirements, highly dynamic global trends, breakneck technological advancements, and economic correction

In order to keep up with evolution in the industry, we set out to capture key performance trends across the 100 largest office markets in the U.S. in a series of quarterly ranking reports that compare and score markets across several metric categories — vacancy, pipeline, asking rates, evolution of the coworking space segment, upcoming loan maturities, and quarterly shifts in online searches for both traditional and flexible office space.

See the methodology section for details and read on for highlights of the best-scoring markets, followed by a breakdown of the ranking report by metric category.

Despite changes in the debt economy resulting in more distressed assets showing up and acceptance of changes in office use spreading on a wider scale, we expect the office sector to come up with creative and ingenious ways to handle the higher-vacancy early phases of what is likely to be a reshuffling spreading multiple decades.

Peter Kolaczynski, Director, CommercialEdge

Key Takeaways

Top 10 Office Markets in Q3

- Boston bags top scores for vacancy, pipeline and asking rates to rank #1 in Q3 2024 among office markets larger than 100 million square feet. San Diego and Orange County complete the podium.

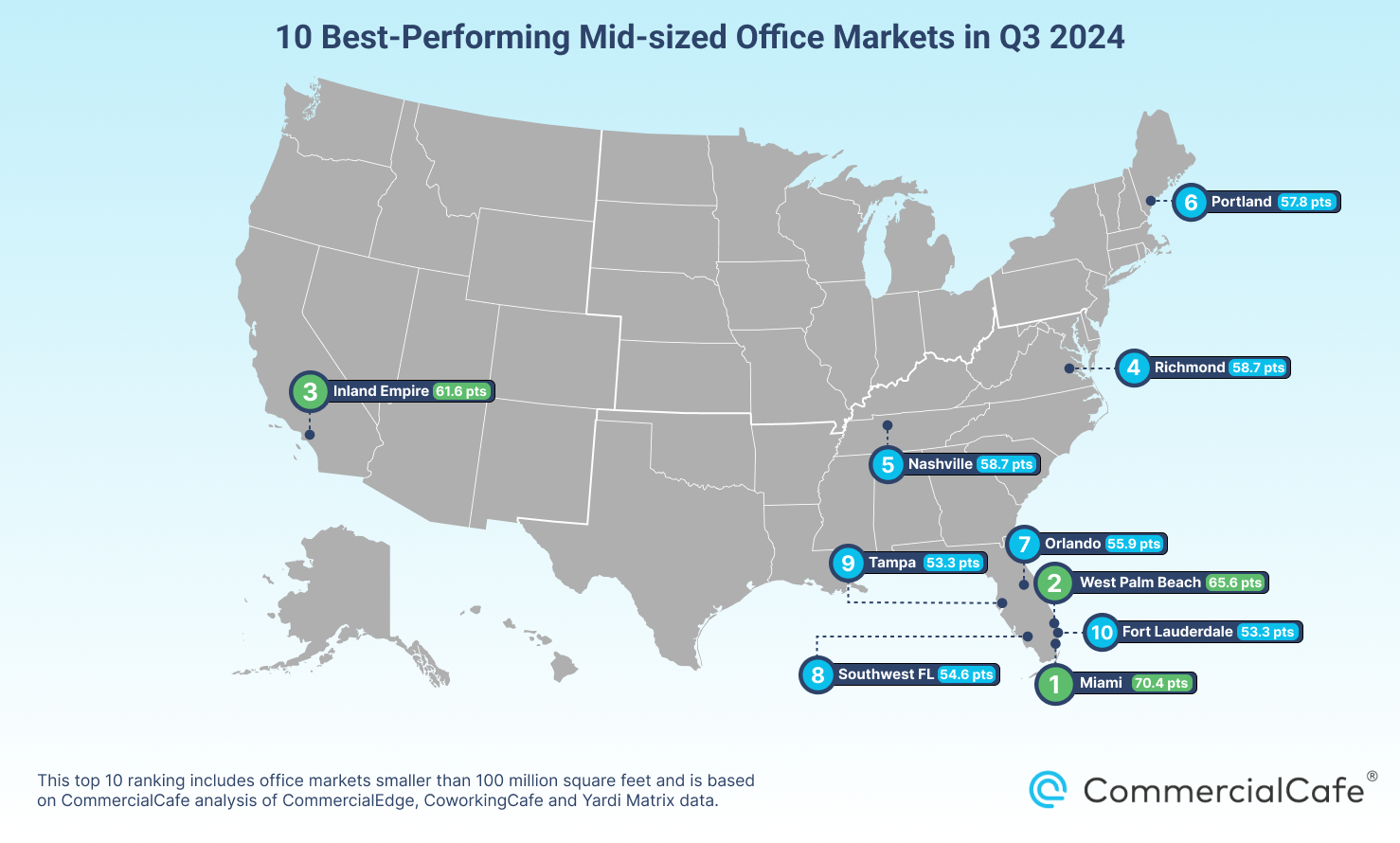

- Miami’s office development pipeline propels the market to the top of the chart for entries smaller than 100 million square feet. It’s followed by the West Palm Beach-Boca Raton, Fla., and Inland Empire, Calif., office markets.

Top Scores for Each Ranking Metric Category (jump to section)

- Vacancy: Nearly 20 office markets saw a quarter-over-quarter drop in vacancy, but none marked a decrease greater than 3%.

- Asking rent: More than half of the 100 office markets we compared saw an increase in average asking rent from Q2 to Q3.

- Office construction: Pipeline data showed more than 102 million square feet added across the 100 largest markets during Q3. Austin, Texas, boasts the largest pipeline under construction in Q4.

- Coworking space: The local coworking scene expanded during Q3 2024 in nearly 85% of the markets we compared.

- Loan maturities: Austin, Texas; the Bay Area; and San Diego are looking at the lowest percentages of loans maturing in 2024.

- Search trends: Year-over-year online search trends show steady interest in both coworking and office space.

Top 10 Office Markets Larger Than 100M Square Feet

We still see significant post-2020 fluctuations in market fundamentals across the U.S. office sector. Most notably, very dynamic leasing rate trends due to large amounts of space moving online and offline, in conjunction with changes in how office space is being marketed. What’s more, new project deliveries disproportionately affect both asking rate averages and vacancy rates, all of which support the expectation to see greater fluctuations than we were previously used to, both year-over-year and even from one quarter to the next.

Peter Kolaczynski, Director, CommercialEdge

With a total of nearly 78 points out of 100, Boston scored best among the larger office markets we analyzed. In fact, the Massachusetts powerhouse stood out for several metrics, including pipeline, vacancy, and asking rates. Although Boston office space was not spared by the nationwide trend of vacancies, it nevertheless presented the second-lowest Q3 vacancy rate in this group. And, with more than 13 million square feet of office space added during this year’s third quarter, Boston boasted the largest deliveries pipeline. Furthermore, developers here had nearly as much under construction at the start of Q4, which amounted to nearly 4% of stock that’s currently in the works.

The market also claimed the highest score for its year-over-year increase in average asking rent, which was partially the result of continuing flight to quality: Tenant interest remains notably concentrated on best-in-class assets, which ask for higher asking rates.

San Diego claimed the second-highest score in the large markets ranking, earning notable performances across several of the metrics we compared. Specifically, in Q3 2024, the California market added the third-most office space as a percentage of stock (nearly 4%). Similarly, the local under-construction pipeline also represented the third-largest market expansion in development at the start of Q4 among the larger markets in our ranking.

Orange County ranked third among the larger markets in Q3 2024. During the last quarter, the second-highest-scoring California entry had the fifth-lowest vacancy rate; attracted the second-highest year-over-year increase in the average monthly online searches for office space; and earned the fifth-best score for increase of asking rates throughout 12 months.

Next, Manhattan scored fourth-best among the larger markets in Q3 2024. The market’s strongest suits were vacancy, online interest in office space, and loan maturities. Here, the Big Apple’s office space had the third-lowest vacancy rate last quarter and attracted the third-highest 12-month increase in monthly online searches. At the same time, office loans maturing represented 4.6% of the total for the fifth-highest score for this metric.

Then, as the last of three California office markets to make the top 10, LA rounded out our top five in Q3. The vacancy rate for office space in Los Angeles was the lowest among entries larger than 100 million square feet. The City of Angels was also the office market to see the largest decrease in vacancy from the previous quarter.

On the opposite coast, Philadelphia earned the sixth-highest score among the larger markets by standing out for: the sixth-highest year-over-year increase in average asking rent for office space; the sixth-largest market expansion as a percentage of stock (nearly 2%); the seventh-most office space added between July and September 2024; and the seventh-lowest vacancy rate in Q3.

Meanwhile, Washington, D.C. took seventh place in Q3. Its best-scoring metrics include vacancy (the sixth-lowest rate in Q3) and a boost to the local coworking scene with the fourth-most coworking space square footage added among the larger markets in our ranking.

Nearby, Baltimore — which scored eighth-highest among the larger markets — claimed its most notable performances for metrics related to the local coworking scene. In particular, Charm City was third for the growth of its coworking segment in the local office market. It also attracted the fifth-largest year-over-year increase (of the large markets in the ranking) in the average monthly online searches for coworking space.

It’s worth noting here that there are several factors nurturing the growing local coworking scene. Among them, Baltimore’s unique cultural character, rich history, and relatively affordable living continue to attract residents and workers to the central business district. Additionally, the city’s abundance of remote-friendly office jobs, strong community spirit and quirky community spaces fuels its rise among the best U.S. cities for working parents, as well as being one of the top places to launch an MBA career.

Phoenix, ninth among markets larger than 100 million square feet, earned the second-best score for its decrease in vacancy rate compared to the previous quarter. The Arizona market’s best-performing metrics also included loan maturities (the fourth-lowest percentage of loans maturing this year), in addition to the growth of its coworking segment in the local office market with the fifth-best score.

Not to be outdone, Austin, Texas, wrapped up the top 10 in Q3 after earning its best scores for metrics pertaining to the local office pipeline. Namely, the Texas market added the third-most office space in Q3, which represented the largest market expansion as a percentage of stock (nearly 6%). Similarly, Austin boasted the largest under-construction pipeline: Office space in development here amounted to a little more than 4% of stock at the start of Q4.

Top 10 Office Markets Smaller Than 100M Square Feet

With a total score of roughly 70 points out of 100, Miami ranked first among office markets smaller than 100 million square feet in the third quarter. Plus, the sunny Florida destination boasted a noteworthy development pipeline: Among this group of markets, Miami added the third-most new office space in Q3 and had the most square footage under construction at the start of Q4.

What’s more, despite an apparent slowdown in new-to-market tenants and headwinds sweeping the national office sector, the Florida gem has remained one of the strongest markets in the U.S. With almost 4 million square feet of Miami office space under construction and recently completed high-end properties commanding unprecedented rents, this city’s magic seems to be in no short supply.

Staying in Florida, West Palm Beach-Boca Raton garnered the second-highest total score among markets with less than 100 million square feet. This was largely due to its performance in two metrics — vacancy and pipeline. The second-best-ranking Florida market in this group, West Palm Beach-Boca Raton also had the third-lowest vacancy in Q3 after claiming the fifth-largest dip in vacancy rate the previous quarter. Development in the south Florida market also stood out for its under-construction pipeline with the fourth-most office space in development at the start of Q4 2024 as a percentage of stock.

Across the country, Inland Empire, Calif., took third place in the smaller markets ranking and was the only mid-sized market west of the Mississippi to rank in this top 10 in Q3 2024. Keep in mind that, last quarter, the California office market boasted the lowest vacancy in this group, despite a roughly one percentage point increase from May to September of this year.

Back on the East Coast, Richmond-Tidewater in Virginia received the fourth-best score among the mid-sized entries in our ranking. In this case, its best-performing metric pertained to the growth of its office segment. More precisely, the nearly 1.4 million square feet of office space added here during Q3 marked the sixth-largest market expansion in this group. Then, Richmond-Tidewater earned its next-best score for vacancy as the market had one of the 10 lowest rates of unoccupied office space in Q3.

Nashville, Tenn., rounded out the top five, primarily due to its performance across pipeline and coworking metrics: Within this group, Nashville added the most office space square footage during Q3 and had the third-most office space under construction at the start of Q4. Notably, the Tennessee market also stood out for having added the most coworking space during this year’s third quarter, which amounted to the fourth-best score for the growth of its share of coworking out of the total office space in the market.

In the Northeast, Portland, Maine, landed sixth-best among mid-sized office markets. The city earned its best score for the growth of its coworking scene: Coworking square footage added in Q3 made for the largest growth of the share of coworking in the local office market among the entries in this ranking. Portland also boasts several attractive advantages for fans of flexibility, some of which placed it among the best cities for remote work, according to a recent ranking by Remote.com. These include high cultural diversity, which makes it a good destination for international workers on the go; housing costs below the national average; and cool coastal weather, just to name a few.

Orlando, Fla., placed seventh, mostly on the shoulders of its performance in the expansion of the local coworking scene and office asking rate growth. To that end, in Q3 2024, the central Florida market added more than 180,000 square feet of coworking space, which marked the fourth-most such expansion among the entries in this group. Data also showed that Orlando office space saw the fourth-largest increase in average asking rent — roughly 13% year-over-year.

Still in Florida, the Southwest Coast market landed eighth in this ranking group after earning its best score for office vacancy. Specifically, the Florida entry had the second-lowest vacancy in Q3 among markets smaller than 100 million square feet. That followed a modest, 0.2-percentage-point dip from the previous quarter.

Slightly north, Tampa-St. Petersburg-Clearwater was the ninth-best scoring market in Q3. The Florida metro attracted the third-highest increase in average monthly online searches for office space and scored among the 15 best for expansion of the local coworking scene: With a little more than 82,000 square feet of coworking space added to the market during Q3, Tampa landed in 13th for this metric.

Another Florida metro — Fort Lauderdale — wrapped up the top 10. Its best-scoring metrics included the expansion of the local coworking segment, vacancy, and asking rate. Here, the nearly 145,000 square feet of coworking space added to the office segment in Q3 was the seventh-largest such expansion among the mid-sized markets we surveyed. As such, it made for the seventh-largest increase of the coworking segment out of the city’s total office space among the mid-sized markets we analyzed. Meanwhile, office vacancy saw the biggest decrease from the previous quarter (2.4 percentage points). The average asking rate for office space here in Q3 was nearly 12% higher year-over-year, for which the Florida market scored slightly ahead of Raleigh-Durham in North Carolina.

Top-Scoring Office Markets for Each Ranking Metric

1. Top-Scoring Markets by Vacancy Rate at Close of Q3

Naturally, the low-end range of vacancy rates among larger markets was notably different than the 10 best-scoring smaller markets. That’s because gateway and primary destinations traditionally concentrate a significantly higher density of office space and feel any shift in occupancy accordingly. In fact, it was double digits across the top 10 entries larger than 100 million square feet (from 16.3% to 18.6%), while vacancy rates drifted to single-digit values for a precious few in the mid-sized markets group (from 7.1% to 13.9%).

Markets Larger Than 100M Square Feet: Los Angeles & Boston Claim Highest Office Occupancy in Q3

Data showed that the lowest office vacancy rate among larger markets in Q3 was in Los Angeles, where it rested at 16.3% in September 2024. The second-lowest vacancy was in Boston, where 16.4% of office space was unfilled at the close of the quarter.

Otherwise, Manhattan, N.Y. (#3); Minneapolis-St. Paul (#4); and Orange County, Calif., (#5) were the only other markets larger than 100 million square feet where the vacancy rate was below 17% at the close of Q3.

Markets Smaller Than 100M Square Feet: Inland Empire & Southwest Florida Coast Office Vacancy Below 10% in Q3 2024

Office markets smaller than 100 million square feet tend to fill up more quickly when there’s a shift in tenant interest from gateway locations. These types of boosts in attraction can be due to a combination of factors, such as lower financial barriers to entry, increasing amenitization, and improvements in connection to larger metros in the region.

That said, two well-positioned markets earned the top two scores for this metric: Inland Empire (#1) and the southwest Florida coast (#2) recorded office vacancy rates of 7% and 9%, respectively, at the close of this year’s third quarter. They were also the only office markets in this ranking to see office vacancy below 10%.

2. Top-Scoring Markets for Q-o-Q Percentage-Point Change in Vacancy Rate

Only three of the 22 office markets larger than 100 million square feet experienced a drop in vacancy from Q2 to Q3 2024. Meanwhile, among the office markets smaller than 100 million square feet included in our analysis, 16 markets saw steady or decreasing vacancy rates.

Notably, these decreases were small, as none of the markets in either group saw its vacancy rate drop more than three percentage points from Q2 to Q3 2024.

Markets Larger Than 100M Square Feet: Los Angeles, Phoenix & Chicago Claim Podium With Modest Drops in Vacancy

Only three markets larger than 100 million square feet saw drops in vacancy in Q3 2024 from the previous quarter: Los Angeles earned the top score for changes in vacancy rate after recording a nearly one-percentage-point slip since Q2. Phoenix followed in second place and Chicago in third, each with a nearly flat quarter-over-quarter office vacancy rate.

Markets Smaller Than 100M Square Feet: Fort Lauderdale & San Antonio Lead Group With Less Than 3 PPT Q-o-Q Drop in Vacancy

Among the 53 office markets smaller than 100 million square feet included in this ranking report, 15 saw office vacancy rates decrease from Q2 to Q3 2024. Namely, Fort Lauderdale, Fla. — the top-scoring market in this category — saw a drop of 2.4 percentage points from June to September 2024. Next, San Antonio earned the second-highest score for this metric with office space here seeing a nearly two-percentage-point decrease in office space vacancy during Q3. Then, the third-best score went to Birmingham, Ala., where office space vacancy slipped 1.4 percentage points compared to Q2 2024.

Markets Larger Than 100M Square Feet: Boston Leads Ranking for Y-o-Y Asking Rate Growth

At the close of Q3, Boston logged the highest 12-month asking rate boost among the larger markets included in our ranking report. Dallas-Fort Worth followed in second place for this metric with asking rents here in September 2024 averaging 12% higher than in September 2023. Staying in the Lone Star State, Austin, Texas, scored third in this respect with a year-over-year increase of 9% compared to Q3 2023.

Then, Atlanta; Orange County, Calif.; and Philadelphia landed fourth, fifth, and sixth, respectively, scoring much closer to one another than the markets in the top three positions. Specifically, average asking rents for Atlanta office space increased 7% from September 2023 to September 2024, while office space in Orange County asked for 6.4% higher rents at the close of Q3 this year compared to the last. Philadelphia asking rents grew 6.2% during that same time. Each of the remaining top 10 entries saw more modest rent growth of less than 4%.

Markets Smaller Than 100M Square Feet: Kansas City Sees Largest Y-o-Y Upswing in Asking Rents

Scale is a key consideration when looking at office markets smaller than 100 million square feet. That’s because a comparatively smaller change can translate into a larger leap in terms of the percentage represented by that change. This is especially visible in year-over-year changes in the average asking rent for office space when secondary or emerging markets see a significant boost in appeal due to their lower barrier to entry compared to a primary market.

For example, data showed that Kansas City had the largest-percentage increase in asking rates at the close of Q3 2024 compared to the year before. Specifically, a boost from $21 per square foot in September 2023 to $25 per square foot in September 2024 represented a 12-month increase of nearly 20%.

Likewise, the average asking rate for office space in Indianapolis increased 19%, which earned the Indiana market the second-best score for this metric in this group. Miami followed in third place with a 12-month average asking rate boost of roughly 16%.

1. Largest Office Market Expansions in Q3 2024

While deliveries of new office space generally mean larger square footage totals in the case of larger markets, the same may not be true for the percentage of stock that those totals represent because they reflect against the overall scale of the market. For instance, the greatest expansion as a percentage of stock among office markets larger than 100 million square feet was less than 5%, yet it amounted to nearly 13 million square feet of office space. Meanwhile, the largest percentage expansion among mid-sized markets was nearly 4% of stock and incorporated almost 2.4 million square feet of new office space.

Markets Larger Than 100M Square Feet: Boston Claims Top Pipeline Score With 13M Square Feet Added in Q3

Boston got the top score for adding the most office square footage during Q3 (a little more than 13 million square feet), but this total represented a little less than 5% of stock. During the same timeframe, Austin, Texas, (the third-best for this metric) grabbed the top score for market expansion as a percentage of stock: Developers here delivered more than 5.5 million square feet of office space in Q3, which represented an expansion of nearly 6% of stock.

The second-largest Q3 delivery pipeline among larger markets was in San Francisco with nearly 5.7 million square feet or 3% of stock. Similar to Austin, Seattle scored fourth for this metric after adding a little more than 5.5 million square feet of new office space during Q3 2024.

Markets Smaller Than 100M Square Feet: Nashville & Raleigh-Durham Only Mid-Sized Markets to Add 2M+ Square Feet in Q3

When looking at new office space delivered across smaller markets in Q2, Nashville, Tenn., earned the highest score for its nearly 2.4 million square feet completed since the close of Q2. This also earned Music City the highest score for market expansion as a percentage of stock (3.56%).

Further east, a little more than 2 million square feet of office space was delivered across the Raleigh-Durham market in North Carolina in Q3, which was the second-most office square footage added among the markets in this ranking. Miami followed in third place with 1.9 million square feet of new office space completed in Q3.

2. Largest Office Space Pipeline Under Construction in Q4 2024

In addition to market expansion in terms of square footage delivered during Q3 and the percentage of stock it represented for each market, we also looked at the development pipeline of projects under construction at the start of Q4. In particular, we attributed ranking scores for local market expansion in terms of the percentage of stock that was in development at the start of Q4 in each market.

Office Space Under Construction in Q4 as a Percentage of Stock in Markets Larger Than 100M Square Feet

The largest percentage of stock that was under construction at the start of Q4 was in Austin, Texas, with 4.2% of stock in various stages of development to earn the highest score for this metric. Boston was second with 3.8% of stock under construction. Otherwise, office projects in progress in San Diego added up to 3.6% of stock, which placed the California market third on this list.

Office Space Under Construction in Q4 as a Percentage of Stock in Markets Smaller Than 100M Square Feet

Miami took the pipeline lead among office markets smaller than 100 million square feet. Here, projects under construction at the start of Q4 represented nearly 5% of stock, which earned the Florida market the highest score for this metric.

Omaha, Neb., got the second-best score with a Q4 development pipeline representing 3.5% of stock. It was followed closely by Nashville, Tenn., in third place (3.3% of stock in progress).

Markets Larger Than 100M Square Feet: San Francisco & Chicago Lead Coworking Market Growth in Q3

San Francisco added the most coworking space and received the top score for its coworking expansion of roughly 382,000 square feet. Even so, this expansion had only a modest effect on the share of coworking space out of the local office market: It represented a less-than-1% positive difference from Q2 to Q3.

Chicago earned the second-best score for coworking space added during Q3 (316,000 square feet). The Windy City scored ninth for what this square footage represented in terms of expanding the share of coworking out of the total office space in the market.

Each of the remaining top 10 entries added less than 300,000 square feet of coworking space. Bridgeport-New Haven, Conn., scored best of these (#3) for the roughly 275,000-square-foot boost of coworking space it added in Q3, which increased the share of coworking from 1.2% of office space in Q2 to 1.5% in Q3.

Markets Smaller Than 100M Square Feet: Nashville Adds Most Square Footage, Portland, Maine, Claims Largest Percentage-Point Market Expansion

Nashville was in the lead among office markets smaller than 100 million square feet for coworking space added during the year’s third quarter: Its coworking scene grew by roughly 244,000 square feet compared to Q2 and was one of only two among this ranking group to record a market expansion of more than 200,000 square feet. However, it didn’t do much to boost the share of coworking space out of the total office in the market: The coworking space added in Q3 represented only a 0.4%-point increase.

Next, Portland, Maine, added nearly 86,000 square feet of coworking space in Q3, which made for a nearly 1% increase in the local coworking segment out of the total office space to earn Portland the top score for this metric.

Markets Larger Than 100M Square Feet: <4% of Total Maturities Due in Austin, Texas; Bay Area; & San Diego

Austin got the best score for this metric among office markets larger than 100 million square feet. Here, loans due to mature in 2024 represented a little more than 2% of the total future maturity value for loans tied to Austin office assets.

The next two best-scoring markets are also looking at less than 4% of future loan maturities coming due in 2024: The Bay Area received the second-best score (3.6%) and San Diego came in third (3.7%).

Despite having the largest dollar value of loans maturing this year, Manhattan also ranked among the markets with the lowest percentage of maturities — 4.6%, which earned the fifth-highest score for this metric and serves as a good example of the importance of proportions.

Meanwhile, we found Minneapolis-St. Paul on the other end of the scoring scale: The roughly $926 million in loans reaching maturity in 2024 in the Twin Cities office market accounted for more than 13% of the total loans here, which was the highest percentage among office markets larger than 100 million square feet.

At this end of the ranking, Los Angeles and Boston are the office markets making a statement for scale and proportions. More precisely, the $5.4 billion in loans that reach maturity in 2024 in Los Angeles represent more than 12% of total loans in the market — the second-highest percentage in the ranking behind only Minneapolis-St. Paul. Next, Boston’s nearly 12% of loans maturing this year was the third-highest percentage on the list. Notably, this represents loans of nearly $5 billion, which follows only LA and Manhattan in terms of dollar value.

Top-Scoring Markets for Online Office Space Searches

Among the 22 office markets larger than 100 million square feet included in this ranking, 15 saw an increase in their average monthly volume of searches for office space. In particular, the Austin, Texas, office market earned the top score for its 85% boost in search volume compared to the monthly average in Q3 2023.

Otherwise, when comparing office markets smaller than 100 million square feet, we noted seven markets showing a decidedly positive difference. The rest of the top 10 entries showed little to no difference in the average monthly search volume from the previous quarter.

Top-Scoring Markets for Online Coworking Space Searches

Among the 10 best-scoring large markets in the ranking, there were four entries that saw more than a 10% positive difference from the previous quarter — Orange County (#1), San Diego (#2), Los Angeles (#3) and Dallas-Fort Worth (#4).

At the same time, the average monthly search volume for coworking space in markets smaller than 100 million square feet increased for nine of the entries in our ranking. Granted, in comparably smaller coworking markets, a slight difference in numbers can translate to a large difference in percentage.

Case in point: Fort Wayne, Ind., earned the top score for this metric with a Q3 average monthly search volume that was 125% greater year-over-year. However, the actual number of average monthly searches for coworking space in the Indiana market was the second-lowest among the top 10 entries.

Meanwhile, Miami had the largest number of average online searches for coworking space in this group both in 2023 and in 2024, but the percentage difference between them reached just seventh-best in the top 10.

Methodology

For this ranking, we compared the 100 largest office markets in the U.S. (by total office space square footage) across several indicators — office space lease rate, vacancy, the local coworking segment, pipeline activity, loan maturities, and online search interest for each location on the list. All individual ranking metrics are explained further below.

We based our analysis on commercial real estate data and research from CommercialEdge, CoworkingCafe, and Yardi Matrix, as well as analysis of Google search trends. For a fairer comparison, we divided the dataset into two groups and chose the cutoff threshold to be at 100 million square feet. Each group was then comparatively ranked separately. Furthermore, to account for the occasional percentage-value volatility in markets with low leasing activity, the final rankings include only those markets where the average asking lease rate was calculated based on at least 100 listings.

A certain number of maximum points was attributed to each metric. This total was evenly distributed between the lowest and the highest metric values in each of the two groups. On this scale, a score was calculated for each location based on its metric values. The factors (metrics or indicators) on which we based the composite scores are explained below.

For average vacancy rate and loan maturity rate, the number of points awarded was inversely proportional to the metric values. For all other indicators, the number of points awarded was directly proportional to the metric values.

- Refers to the year-over-year comparison between asking lease rates in each office market between the last month of Q3 2023 and the last month of Q3 2024. This metric reflects the percentage change in asking rate during that 12-month time period.

- Maximum points: 20

- Data source: CommercialEdge

- In this category, we looked at two aspects:

- the vacancy rate for each market in the last month of Q3 2024 (a metric for which we attributed a maximum of 25 points)

- the percentage point change in vacancy rate compared to the last month of Q2 2024 (for which we attributed a maximum of 5 points)

- Maximum points: 30

- Data source: CommercialEdge

- This metric category included three indicators:

- office square footage added during Q3 in each of the locations we included in the ranking (maximum 10 points)

- office space added as percentage of total inventory between June 2024 and September 2024 (maximum 5 points)

- office space under construction at the start of Q4 as a percentage of total market inventory (maximum 10 points)

- Maximum points: 25

- Data source: CommercialEdge and Yardi Matrix

- In this category, we looked at two aspects:

- the change in total coworking space square footage for each market compared to the previous quarter (a metric for which we attributed a maximum of 2.5 points)

- the percentage point change of the coworking share out of total office space in each location compared to the previous quarter (maximum 2.5 points).

- Maximum points: 5

- Data source: CoworkingCafe

- This metric refers to the total of loans that are due to mature in 2024 as a percentage of total loans in the market.

- Maximum points: 10

- Data source: CommercialEdge

- As a potential indicator of tenant interest in the market, we looked at changes in the monthly average volume of online searches for both office and coworking space compared to the monthly average at the same time in the previous year. We attributed a maximum of 5 points for each property type.

- Maximum points: 10

- Data source: in-house analysis of Google searches for office- and coworking-related keywords